Client

Belitsoft was contacted by the founders of a startup from one of the EU Member States. They wanted to create a mobile app that would support SEPA Instant Credit Transfer (SCT Inst) scheme to make real-time payments.

Challenge

The global trend is the increased third-party demand to connect to the Open Bank API. As this technology allows the banks to increase the number of transactions, it serves as an incentive to comply with SEPA requirements and make their APIs better.

SEPA scheme cover 36 countries and territories, including 28 EU Member States, as well as Iceland, Norway, Liechtenstein, Switzerland, Monaco, San Marino, Andorra, and Vatican City State/Holy See. Today 2079 payment service providers (PSPs) have already joined the scheme (51% of European PSPs).

According to the PSD2’s Regulatory Technical Standards (RTS), banks across the EU are required to have implemented their dedicated interfaces (open API) for third parties to use by September 2019.

However, most of the EU banks (their UK counterparts are doing better) still have trouble with the technical side of the matter. The available APIs aren’t mature enough. The main reason for this is the banks’ reluctance to make some of their inner workings 100% open.

Process

Open Banking API Gateway Platform

In our experience with API development, many banks don't adhere to RESTful API implementation standards, and not all possess specialists to debug interactions with their APIs.This increases the time needed to integrate another bank with client’s solution. Moreover, this forces developers to make changes in the existing modules, creating an error risk.

To solve this problem, our dedicated mobile app developer created an intermediary layer - a Gateway API that would let us connect external banks’ open APIs without affecting the core system of our client.

The app uses a custom-build API Gateway - a backend app, microservice that connects the APIs from European banks that participate in SEPA Payment Scheme and provides a single API. Our client also plans to sell access to this single API as a SaaS product.

Results

PayPal became an investor of this startup.

Features

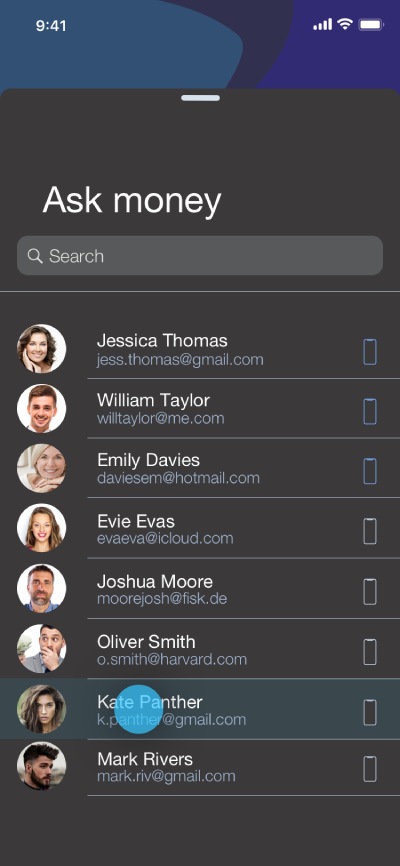

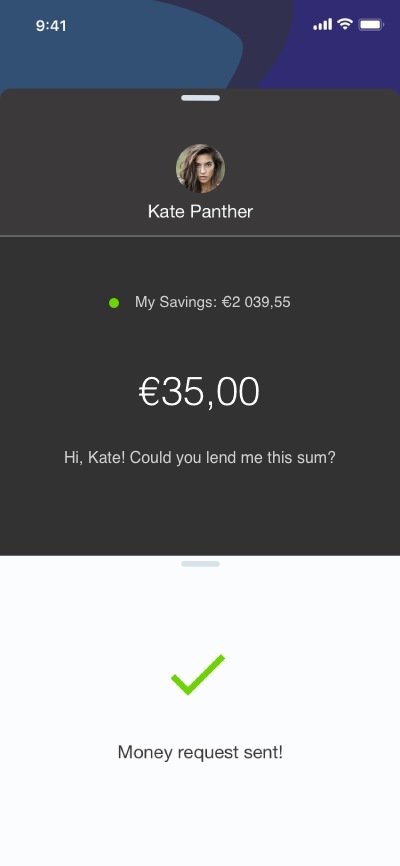

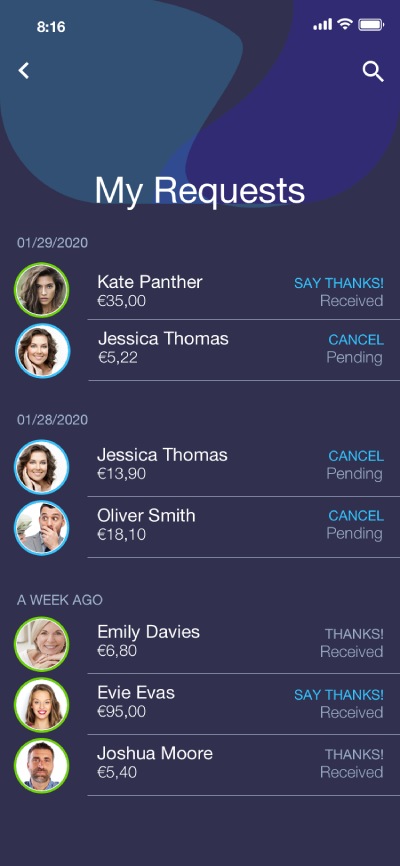

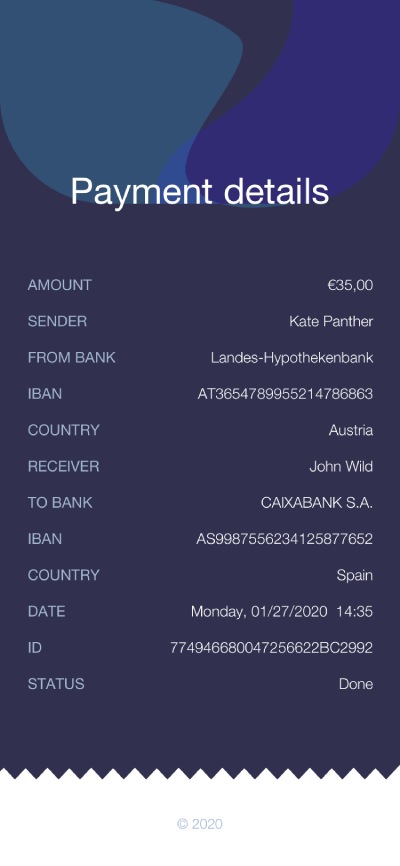

- Person to Person money transfer. Users of this mobile app able to make instant payments (also known as “immediate payments” or “real-time payments”) to their contacts list using a mobile phone.

The features include sending, receiving, or requesting money from any bank account (IBAN) in Europe in seconds with 24/7availability (unlike traditional electronic payments). - Donation & Fundraising functionality. This money sharing app also includes the donation & fundraising feature. Users can send in-app requests for transfers to other users in their contact list. iOS users can also use the iMessage extension.

- Bill-splitting functionality. A user can divide the bill equally between a number of people and send requests for money to each one.

- QR code payment functionality. A QR-code generated by one user is then scanned by another to populate transfer form and quickly send money.

- E-invoice functionality. A company can generate invoices within the app and send them to the customers.

- Online Lending. A user can apply to receive a loan from one of the participating banks.

- Online Deposit. A user can use the app to deposit checks to their accounts.

- Cryptocurrency Wallet. A built-in wallet to store multiple types of cryptocurrency.

- Recurring Payments. The system can send users automatic reminders to pay rent, utilities, or similar bills.

- Favorite Transactions. A user can store the parameters of some transactions to quickly perform these transactions in the future.

- Face ID Authorization. A user can log in to their account and authorize certain actions with their face (Apple devices only).

Our Clients' Feedback

We have been working for over 10 years and they have become our long-term technology partner. Any software development, programming, or design needs we have had, Belitsoft company has always been able to handle this for us.

Founder from ZensAI (Microsoft)/ formerly Elearningforce