Where exactly do life insurance carriers get client information? And what is the potential of EHRs to improve the application process? We found some promising examples of how EHR systems can improve life insurance industry.

When applying for life insurance coverage, there is a wide range of information that the underwriter will ask. Each question relates directly to the amount of premium you’ll pay.

In addition to your name, age, and gender, the company also needs to know about your health status and history. Thus, data on whether you have diabetes or are there cases in your family, as well as any other potential risks, allows insurers to determine the exact amount of a claim.

Where do life insurance carriers get client information?

The primary source of information for life insurers is the application for coverage. In addition to the medical history, an applicant provides, an underwriter may request reports from their healthcare provider or from other insurance companies to which they have applied for insurance.

They may also resort to knowledge bases to obtain additional details on customer background. One such source is the Medical Information Bureau or MIB Inc. If insurers do so, they use the authorization form an applicant signed with their health statement.

What is MIB Inc.?

MIB Group, Inc. is a non-stock corporation owned by nearly 500 insurance companies throughout the US and Canada. The organization was created in 1902 and is America’s oldest and longest continuously operating credit reporting agency accessing 100 million records and growing weekly.

Source: mib.com/facts_about_mib.html

Source: mib.com/facts_about_mib.html

MIB Inc. currently owns North America’s largest database of medical conditions on insurance applicants. Collected medicine-related records may include medical conditions, tobacco usage, alcoholism, drug addiction, and personal or family genetic history.

The information in MIB’s database is encrypted and may be accessible only to authorized personnel of the member company. They contribute underwriting files to the MIB database that may be helpful to other members. Applicants can also provide the MIB with personal medical records from their healthcare provider that are relevant to the disputing conditions.

When customers apply for insurance, they should authorize the use of MIB as an information resource. According to the Federal Trade Commission, MIB is obliged to provide a copy of a consumer’s medical record, if requested, to verify that all information is correct.

EHR - a tool to gather data from life insurance applicants

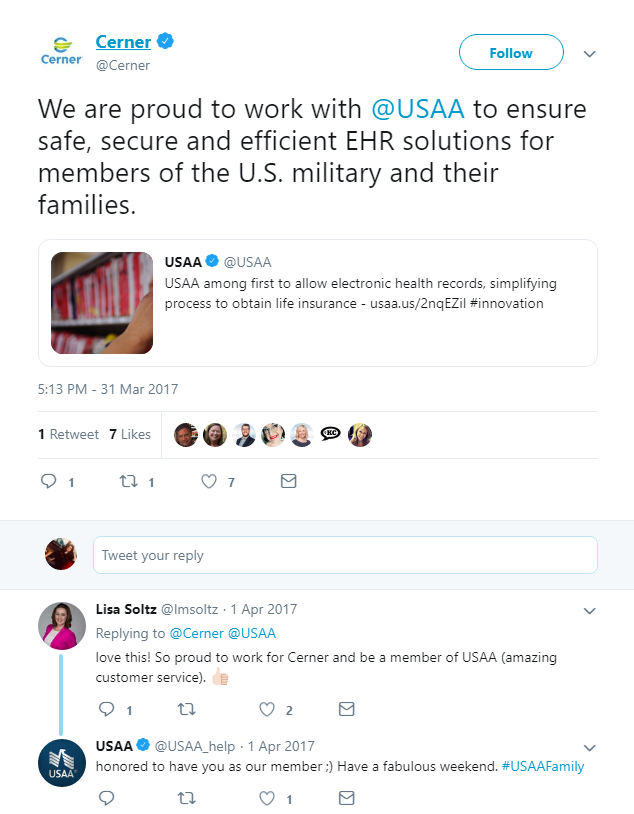

The United Services Automobile Association (USAA) is among the first, who let applicants use EHR to simplify the life insurance purchase progress. The Association worked with Cerner to test and implement EHR retrieval technology named HealtheHistory.

Source: twitter.com/Cerner/status/847814228694237184

Source: twitter.com/Cerner/status/847814228694237184

The solution is available to applicants at the Department of Veterans Affairs and Department of Defense. Thus, they are able to deliver their health data directly to the insurer via the patient portal.

‘We can’t emphasize enough how important life insurance is to a financial plan, but we also understand that the process of obtaining a policy continues to introduce challenges industrywide. By using portal retrieval technology and existing EHR platforms, we can provide our members a more secure, easy way to supply records to get a policy decision as soon as possible.’

Dr. Steven Dunlap, medical director at USAA

HealtheHistory supports health data collection, encrypts data transmission and limits access to approved members. The tool connects to any accessible patient portal, facilitating the delivery of an applicant’s health history up to 30 days faster than manual retrieval options.

Cerner calls this a longitudinal record. The program gathers various sources of raw data, organizes into groups by commonalities, standardizes to match industry terminology, and, as a result, formes a 360-degree view of the applicant.

USAA data shows that one of five members do not carry life insurance, with many citing cost and the application process as the top concerns. Recent stats from the marketing research organization LIMRA indicate the number is much higher for the general population, with over 40% of Americans having no life insurance.

By deploying EHR technology, USAA is able to speed up the application and underwriting process, without increasing cost for members.

MIB Inc.: steps towards EHR integration

In April 2018 MIB Inc. released a platform created to automate the acquisition of applicant-authorized EHR for accelerated delivery to the member insurers. The MIB EHR Data Platform have to replace paper-based APS (Attending Physician Statement) retrieval process by offering a unified method through which MIB’s 400 American insurers can securely access health records.

The corporation is in current negotiations with leading EHR vendors to facilitate the acquisition and delivery of EHR data for the new EHR Data Platform. This platform will allow the insurance industry to drive process optimization, reduce costs and enhance data-driven decision making.

‘The EHR Data Platform naturally aligns with MIB's competencies in technology, data security, user experience expertise and our large-scale network capabilities. Our mission, and the mandate we have to serve our members, empowers us to deliver an industry-wide data solution that helps all our members drive more rapid issue of life insurance to meet market demands. MIB is owned by the industry we serve—we are the obvious choice for EHR delivery to the life insurance industry.’

Lee B. Oliphant, MIB President and Chief Executive Officer, said

Weaknesses of the current system that EHR may resolve

Statistics show that 20% of credit histories from the major credit reporting agencies contain errors. However, the percentage of errors in records from the nationwide specialty credit reporting agencies for insurance (e.g. MIB Inc., Ingenix, and Milliman) is unknown.

Even though no official data is available, it is estimated that about 5% - 10% of medical report files are inaccurate or contain errors.

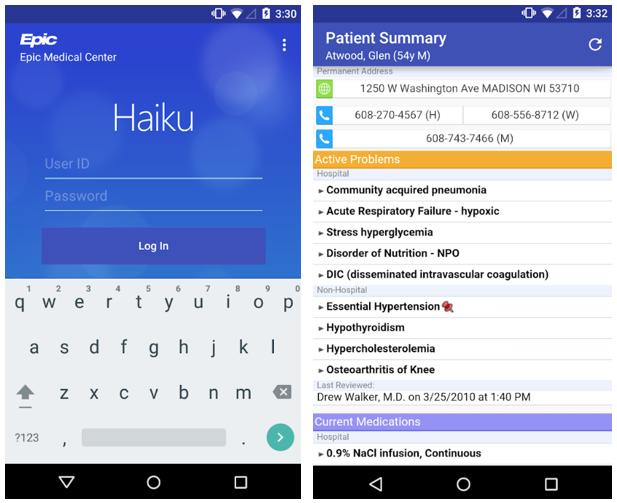

EHR systems, in turn, are a substantial collection of codified data that appears more credible, since physicians add the info manually. Here insurers can find vital records of allergies, medications, surgical procedures, lab results, as well as social determinants of health.

Source: play.google.com/store/apps/details?id=com.epic.haiku.android&hl=en_US

Source: play.google.com/store/apps/details?id=com.epic.haiku.android&hl=en_US

EHRs and coded data they contain can drive life insurance underwriting. However, is it a silver bullet for the industry?

‘On top of that, EHRs still don’t do the necessary job of making patient records easily available to providers and patients. EHRs were originally designed as a tool to help with billing, and they are falling short in their ability to provide data in a portable and accessible format. So in many ways, EHRs have merely replaced paper silos with electronic ones, while providers, and the patients they serve, still have difficulty obtaining health records.’

From the speech of CMS Administrator Seema Verma in HIMSS18 Conference, March 3, 2018

Improve EHR system to meet life insurers needs

According to Health IT Dashboard 2017, 85.9% of doctors and 96% of hospitals use EHR systems. Patients and physicians have widespread access to the Internet and nearly everyone has a mobile device. All of these benefits provide many access points for viewing and upgrading healthcare data.

For the lucky few who get their records, the information is often incomplete, and not always digital or understandable. Customers might be able to get some info in their provider’s portal but if they are consulting different specialists, they might be checking a bunch of portals. As a result, the data is scattered and unstandardized.

The existence of multiple technical and terminology standards that serve similar functions is one of the key issues. Thus, the looming shadow of EHRs interoperability will be settled more quickly.

Plus, communities join into a single data sharing network, in which each participant makes one connection to the web and then can access records from all parties. This is the way Carequality have created a standardized, national-level interoperability framework to link all data sharing networks.

Human API released a new version of their medical data platform for life insurance carriers. The solution leverages the company's nationwide network of EHR, pharmacy, and lab integrations to deliver electronic health data for more efficient underwriting.

‘We started with two simple questions: "why can't consumers access their health data?" and "why do enterprises struggle to connect this data? These questions inspired our mission to create data liquidity throughout the healthcare ecosystem.’

from Human API website

The platform includes the Enterprise Portal, where insurers can request real-time access to medical records, view the results in a longitudinal timeline, and leverage a robust clinical data flow to automate underwriting decisions. With no IT integration required, the solution enables insurance carriers to incorporate Human API into their current underwriting programs.

The adoption of electronic health records has increased rapidly in recent years, opening the door for new approaches to medical record retrieval and direct consumer engagement.

‘Attending physician statements (APS) have always been the gold standard for underwriting, but they take too long and cost too much. The ability to directly access EHR data will be the biggest game changer for underwriting in my now very long career. Companies who figure out how to access digital EHR data first will find a distinct competitive edge in the marketplace’

Jennifer Richards, the Head of Life Insurance New Business and Underwriting at Mass Mutual

Conclusion

Despite the comparatively large hundreds-years-old databases, EHR information has the potential to essentially shatter and improve the life insurance risk assessment process. More and more companies made the investment to incorporate EHRs into their automated underwriting programs. The benefits are clear - EHR can reduce application time while improving customer experience.

Hire Belitsoft - a top offshore software development company!

Rate this article

Recommended posts

Our Clients' Feedback

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

We have been working for over 10 years and they have become our long-term technology partner. Any software development, programming, or design needs we have had, Belitsoft company has always been able to handle this for us.

Founder from ZensAI (Microsoft)/ formerly Elearningforce